Ways to Bank

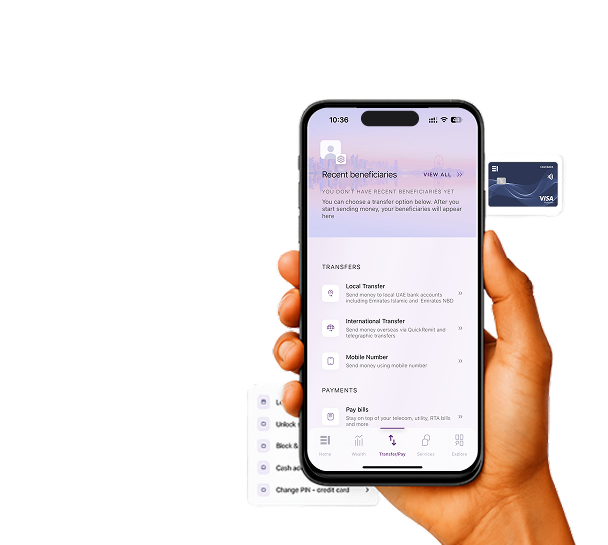

Stay connected with Emirates Islamic through the EI + Mobile Banking App and EI + Online Banking — simple, secure, and Shariah-compliant.

Have an account with us already?

Have a card with us already?

Have a finance with us already?

Other ways of banking

Useful links

About Priority Banking

Our banking solutions

Wealth Solutions

Digital banking

Bespoke solutions

Useful Links

Insights

Start & Grow Your Business

Running Your Business

For Established Business

Our Financing Solutions

Cash & Payment Solutions

Our FX & Trade Services

Useful links

Emarati Business Banking

Useful links

About Corporate Banking

Emirates Islamic brings you exclusive Home Finance solutions to construct your house or buy a new home under the Sharjah Department of Housing. We proudly support UAE nationals from the Emirate of Sharjah beneficiaries in achieving their goal of owning a home and bringing families together.

Home finance of up to 800,000 for construction or home purchase

Flexible payment periods of up to 25 years to suit your financial plans

Pay your instalments easily through direct debit for a smooth experience

Customers applying for Additional Finance with Emirates Islamic will enjoy:

Home Finance as added support for constructing or purchasing your home

Tailored solutions designed to meet the unique needs of your dream home

To complete your Home Finance application, please prepare the following personal and property documents for verification and approval.

* For Government/Semi-Government organizations, salary credited to the customer’s Emirates Islamic account is considered as evidence of assignment.

Required property documentation includes:

For Conditional Approval:

If Applying for Additional Finance with Emirates Islamic:

Protect your loved ones and your home with Takaful coverage designed to safeguard against unforeseen circumstances, damage, and unexpected events press the icon to view the full policy document.

After submitting your documents, the bank will assess your financial eligibility as per CBUAE guidelines & regulations.

Once the property is ready and handed over, Emirates Islamic will initiate property Takaful coverage through one of its empaneled takaful providers for any loss or damage.

You can check the outstanding balance of your home finance by logging on to mobile or online banking or you can call us at 600 599 995. Priority Banking customers can contact us at 800 111 22.

No, Emirates Islamic does not charge any additional profit on accrued profit on any credit product granted to customers.

Need help with your Home Finance? Reach out to us.

Home Finance Service Center, 01 Floor,

ENBD Building, King Faisal Street,

Sharjah Location