Ways to Bank

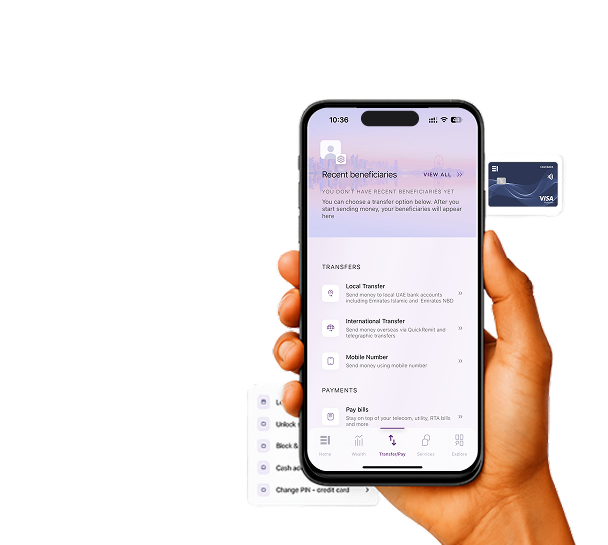

Stay connected with Emirates Islamic through the EI + Mobile Banking App and EI + Online Banking — simple, secure, and Shariah-compliant.

Have an account with us already?

Have a card with us already?

Have a finance with us already?

Other ways of banking

Useful links

About Priority Banking

Our banking solutions

Wealth Solutions

Digital banking

Bespoke solutions

Useful Links

Insights

Start & Grow Your Business

Running Your Business

For Established Business

Our Financing Solutions

Cash & Payment Solutions

Our FX & Trade Services

Useful links

Emarati Business Banking

Useful links

About Corporate Banking

With competitive profit rates, and high finance amounts, Emirates Islamic Personal Finance can help you achieve your goals. Whether you’re looking to find funds for a home renovation project, go on a dream vacation or rent a home, our Shariah-compliant finance is the product for you. To learn what your installments would be, use our easy Personal Finance calculator and apply now.

Profit rates start from 2.59% flat p.a for UAE Nationals (approx. 4.74% reducing rate p.a) and 2.99% flat p.a for Expatriates (approx. 5.47% reducing rate p.a).

Choose payment plans up to 4 years tailored to your needs.

Secure up to AED 4 million for UAE Nationals, AED 3 million for Expatriates.

Monthly Payments

Terms and conditions apply. Profit rates vary by tenor & subject to bank policy

emoji_objects Smart Money Habits: 6 Ways to Spend Wisely

Read morechevron_right

Minimum monthly salary of 7,500 for UAE Nationals and Expatriates

Minimum one month of service / first salary credit into Emirates Islamic account

Applicants must be at least 21 years old.

Maximum age is 65 for UAE Nationals and 60 for Expatriates at the time of maturity.

Up to 48 months for all employers and up to 60 months for Ministry of Defence employees only

Terms and conditions apply and are subject to change solely at the Bank’s discretion. Trading commission as applied by the broker will be levied to the customer.

Prepare these essential documents to ensure a smooth and fast approval process for your Emirates Islamic Bank Personal Finance application.

Completed application form

Copy of valid passport with UAE residence visa (original for verification)

Last three months bank statements

Salary transfer letter or salary certificate (for salaried customers)

Liability letter (for debt settlement to third party cases only)

Emirates Islamic Personal Finance is a Shariah-compliant product based on the Shariah concept of Murabaha.

Murabaha is a contract for the sale of certain assets, which in this case are EI Funding Certificates. The bank sells the assets to the customer for the cost plus the profit margin (markup) as made known and agreed on by all parties. After buying and possessing the assets, the customer sells them to a third party and the sale proceeds are transferred to the customer’s account.

A Borrower is a person or entity who borrows money from someone else. A Financee is a person or entity who agrees to settle a deferred price payable upon the execution of a sale or leasing contract.

Discover a range of flexible financing solutions tailored to fit your lifestyle and goals