Enhanced Pricing for Additional Finance Applicants

- Attractive and highly competitive profit rates linked with EIBOR.

- No additional margin on cash release.

- 50% discount on processing fees (instead of 1% of the finance amount).

Have an account with us already?

Have a card with us already?

Have a finance with us already?

Other ways of banking

Useful links

About Priority Banking

Our banking solutions

Wealth Solutions

Digital banking

Bespoke solutions

Useful Links

Insights

Start & Grow Your Business

Running Your Business

For Established Business

Our Financing Solutions

Cash & Payment Solutions

Our FX & Trade Services

Useful links

Emarati Business Banking

Useful links

About Corporate Banking

Empowering UAE Nationals with Shariah-compliant finance to create a home of their own.

We take pride in supporting UAE National beneficiaries as they work toward owning a home and bringing their families together. Emirates Islamic offers exclusive Home Finance solutions to help you construct your house or purchase a new home under the Mohammed Bin Rashid Housing Establishment (MBRHE) Housing Programme.

Benefit from payment periods of up to 25 years, keeping instalments manageable.

Benefit from up to AED 1,000,000 through the Housing Program, complemented by Emirates Islamic Home Finance.

Enjoy a 50% discount on processing fees instead of the standard 1% of finance amount.

A seamless way to own your home through Shariah-Complaint Forward ljarah

We are proud to bring a special offering designed exclusively for our MBRHE customers. This package is crafted to elevate your everyday banking experience, from tailored service support to thoughtful pricing benefits and lifestyle privileges that add real value to your journey. It’s a personalised way to bank, created with your needs in mind.

Flexible, competitively priced financing to support building or enhancing your home.

Please provide the required documents to help us process your request smoothly.

Protect your loved ones and your home with Takaful coverage designed to safeguard against unforeseen circumstances, damage, and unexpected events press the icon to view the full policy document.

Get in touch with our Home Finance team for enquiries, support, and location information.

Your Corporate Executive Credit Card offers coverage for travel accidents, lost luggage, and delays.

Submit claims online at mcpeaceofmind.com.

Accepted worldwide for in-store, online, and government transactions, the card simplifies corporate payments across borders and channels.

Cashbacksouk.ae is an exclusive online shopping portal for Emirates Islamic Cardholders.

Convert your Emirates Airlines purchases made on emirates.com into a 0% Easy Payment Plan. Split your flight costs into three convenient monthly installments, making travel more accessible and manageable for your budget. This offer provides a flexible payment option for your travel needs.

Discover a world of exclusive discounts and privileges with our Mazaya Offers Programme.

Click here to view all Mazaya Offers.

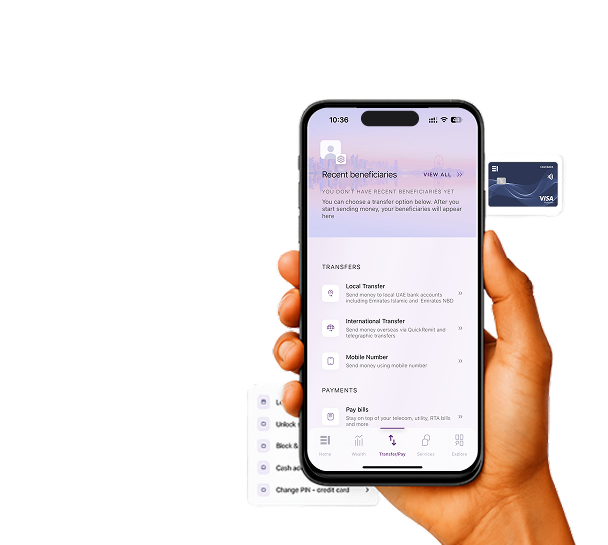

Empower your central coordinator with full access to Emirates Islamic’s Online and Mobile Banking platforms for easy account and card management.

Enjoy up to 2 complimentary Marhaba Silver Meet & Greet services per year for a smoother airport experience. Simply make a minimum monthly retail spend of AED 3,000 on your card to qualify. If the spend criteria is not met, the applicable service fee will be billed to your credit card.

Enjoy 100% automatic debit from your Emirates Islamic Corporate Account — ensuring no payment due date is missed.

As a Corporate Executive Credit Cardholder, you enjoy complimentary access to 25+ airport lounges in key business destinations worldwide.

Terms & Conditions apply. Visit LoungeKey for the lounge list

Book international round-trip flights on Cleartrip.ae using your Corporate Executive Credit Card and get:

Visit cleartrip.ae/mastercard, book yourself an international round trip and use promo code MASTERCARD on checkout.

Stay in control with built-in monitoring tools and real-time alerts that keep your company’s spending secure.

Access Mastercard’s Smart Data Generation 2 (SDG2) — a powerful online platform for data-driven corporate expense management.

Key Highlights:

Safeguard your company from unauthorised transactions with comprehensive liability coverage for each cardholder.

Key Highlights:

Complimentary golf rounds at Arabian Ranches Golf Club, Track Meydan Golf Club, or Yas Links Golf Club. This benefit is valid on both weekdays and weekends for cardholders who meet a minimum monthly retail spend of AED 10,000. Failure to meet the spend requirement or a 'no-show' will result in your card being charged the standard green fee.