Ways to Bank

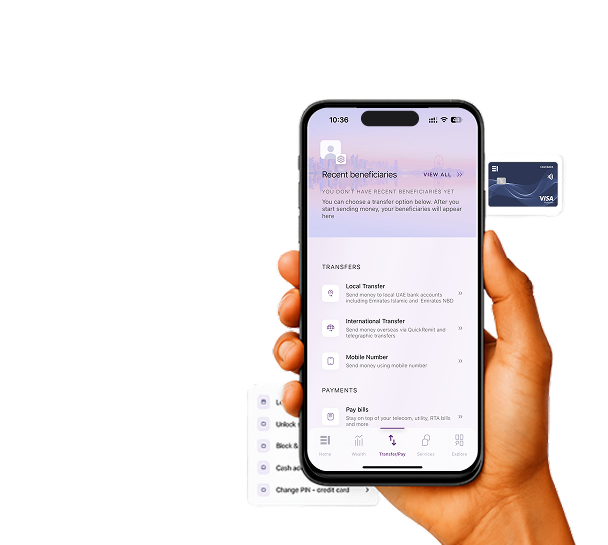

Stay connected with Emirates Islamic through the EI + Mobile Banking App and EI + Online Banking — simple, secure, and Shariah-compliant.

Have an account with us already?

Have a card with us already?

Have a finance with us already?

Other ways of banking

Useful links

About Priority Banking

Our banking solutions

Wealth Solutions

Digital banking

Bespoke solutions

Useful Links

Insights

Start & Grow Your Business

Running Your Business

For Established Business

Our Financing Solutions

Cash & Payment Solutions

Our FX & Trade Services

Useful links

Emarati Business Banking

Useful links

About Corporate Banking

Grow your business plans with Shariah-compliant property finance designed for your commercial, industrial, retail, or residential needs

Our Shariah-compliant Commercial Property Finance helps you acquire the right commercial space for your business, whether office, retail, industrial, or residential. Through Ijara, we finance completed properties and provide customised solutions that support better cash flow and business growth. Enjoy competitive profit rates, quick pre-approvals, and flexible payment options.

Access up to AED 25 million with financing of up to 70% for commercial properties.

Benefit from competitive profit rates that deliver value-driven financing.

Repay over up to 15 years with instalments aligned to your cash flow.

Access Mastercard’s Smart Data Generation 2 (SDG2) — a powerful online platform for data-driven corporate expense management.

Key Highlights:

Safeguard your company from unauthorised transactions with comprehensive liability coverage for each cardholder.

Key Highlights:

Complimentary golf rounds at Arabian Ranches Golf Club, Track Meydan Golf Club, or Yas Links Golf Club. This benefit is valid on both weekdays and weekends for cardholders who meet a minimum monthly retail spend of AED 10,000. Failure to meet the spend requirement or a 'no-show' will result in your card being charged the standard green fee.