Individuals

Who Can Apply: UAE Nationals and Residents, including:

- Minors (through guardians)

- Joint account holders

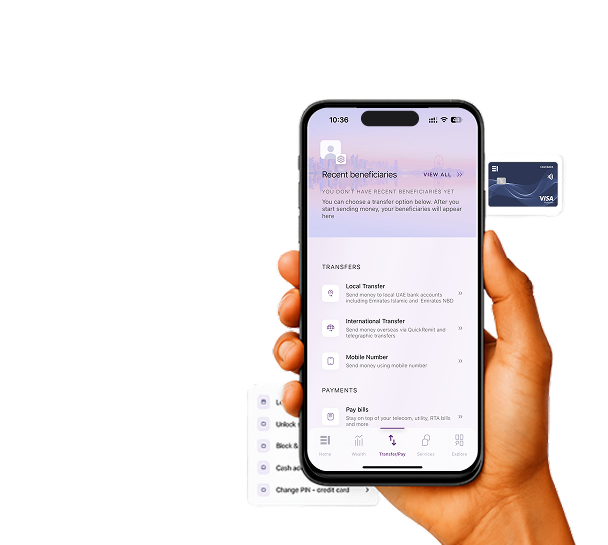

How to Apply:

- Submit your request via Online or Mobile Banking

- Visit any Emirates Islamic branch

- Apply through your Relationship Manager

- Contact the Call Centre for guidance