If You Withdraw Within 0–3 Months

Here’s how your indicative profit is affected:

- You will earn indicative profit at the prevailing Savings Account rate.

- Indicative profit is paid for each full calendar month your deposit remained with the bank.

Have an account with us already?

Have a card with us already?

Have a finance with us already?

Other ways of banking

Useful links

About Priority Banking

Our banking solutions

Wealth Solutions

Digital banking

Bespoke solutions

Useful Links

Insights

Start & Grow Your Business

Running Your Business

For Established Business

Our Financing Solutions

Cash & Payment Solutions

Our FX & Trade Services

Useful links

Emarati Business Banking

Useful links

About Corporate Banking

Lock in your funds for 9 months but still retain the option to withdraw early.

Earnings are paid out every quarter, keeping your funds within reach when you need it.

Available in both AED and USD, so you can choose the currency that works best for you.

Open your Flexi Term Deposit in AED or USD

Your deposit is invested for a fixed 9-month tenor

Indicative profit is credited every three months

You can withdraw before maturity

Receive your full deposit amount along with all due indicative profits at the end of the term

The Flexi Term Deposit allows you to access your funds before maturity, with indicative profits recalculated fairly based on how long your deposit was maintained.

Here’s how your indicative profit is affected:

Your indicative profit will be adjusted as follows:

Any previously paid “Flexi” indicative profit will be recalculated and adjusted to reflect the actual tenure of your deposit, ensuring a transparent and accurate final payout.

Please Note: Indicative profit payments and adjustments are made at the bank’s discretion.

Terms and conditions apply.

A Conventional Bank is a financial body that receives money from depositors and offers liquidity to borrowers at interest. It operates on an interest-based system and is governed by conventional banking laws.

An Islamic Bank is a financial body that executes Shariah-compliant commercial contracts such as sales, leasing, and construction. It operates on a risk, profit-sharing, and trade-based system and is governed by Islamic banking laws under the supervision of an Internal Shariah Supervision Committee.

In conventional banking, Savings Accounts and Fixed Deposits (FDs) pay a predetermined interest rate over a predetermined period. Depositors receive interest regardless of the bank’s performance.

In Islamic banking, depositors earn returns based on the bank’s actual performance. Unlike conventional banks, an Islamic bank acts as an intermediary between the depositor and the financed party. Here, profits are declared on a monthly basis under a profit/risk-sharing scheme known as “Mudaraba or Wakala”.

Interest is a fixed return on a specific sum of money invested over a predetermined period of time (and is not permissible under Shariah).

Profit is an undetermined return on an invested sum over a predetermined period. It may vary month to month, depending directly on the bank’s actual performance (and is permissible under Shariah).

The Flexi Term Deposit is a 9-month Shariah-compliant deposit that gives you steady profits with the flexibility to access your funds before maturity. Profits are paid quarterly, and early withdrawals are allowed with fair adjustments.

There is no fixed minimum, making it flexible for different saving levels. Deposits can be made in AED or USD.

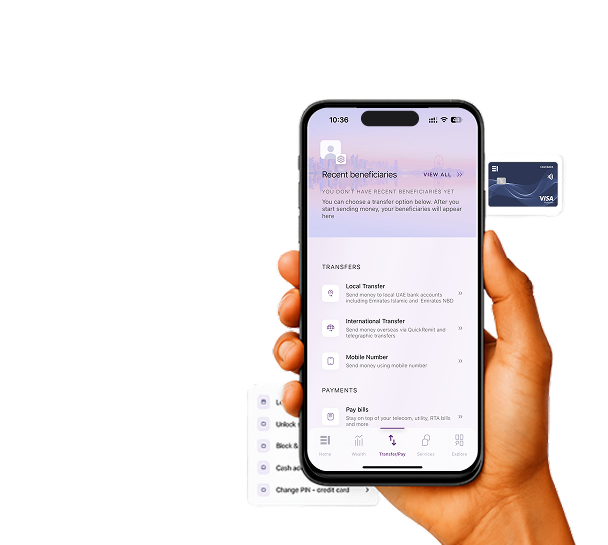

Yes. Individuals can open a Flexi Term Deposit via Emirates Islamic online banking or at a branch. Businesses and minors must complete the process at a branch.

Profit is calculated based on the term deposit rates for completed months, and early withdrawals are adjusted according to the actual duration. All calculations follow Shariah-compliant principles.

Yes, you may top up your Flexi Term Deposit within the first month of opening, subject to the bank’s approval. Additional funds will follow the same profit and tenor structure.

Yes, you can open more than one Flexi Term Deposit in your name or for a minor, each treated as a separate deposit with its own profit calculation.

Currently, Flexi Term Deposits can only be opened by individuals, minors via a guardian, or businesses. Joint individual accounts are not applicable for this product.

Profit will be calculated for the first quarter at the 3-month term deposit rate, and subsequent months at the prevailing Savings Account rate. Any previously credited profits will be adjusted accordingly.

Yes, you can add a nominee to the deposit to ensure seamless transfer of funds in case of unforeseen events. Nomination forms must be submitted at a branch.

Unlike regular fixed-term deposits, the Flexi Term Deposit offers quarterly profit payouts and early withdrawal flexibility, allowing access to funds without waiting for maturity.

There are no penalties, but the profit is recalculated based on the deposit duration, and any previously credited profits will be adjusted.

Yes. Non-resident UAE account holders can open a Flexi Term Deposit, subject to compliance and regulatory requirements.

Non-residents here are individuals who do not live permanently in the UAE but may have financial or business ties to the country. This includes:

Note: Non-residents must meet all documentation requirements such as a passport and proof of overseas address. This is different from short-term tourists or visitors, who generally cannot open term deposits due to residency and documentation rules.

Who can start a Flexi-Term Deposit with Emirates Islamic? And how?

Minor Applicants:

Flexible deposit options designed to help you grow your savings with confidence and ease.