For Existing Customers

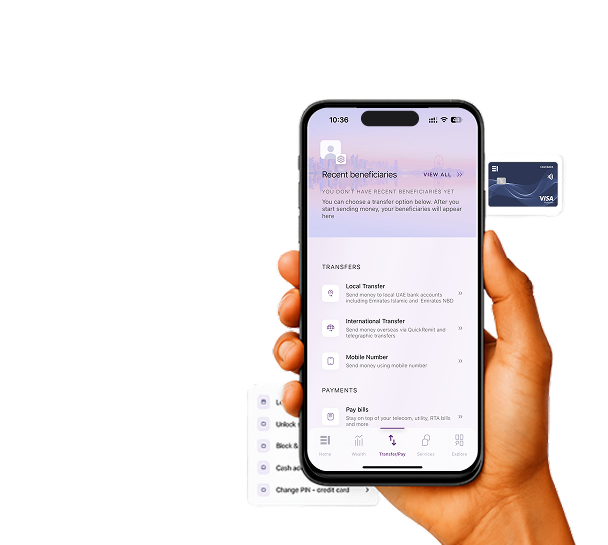

- Log in to your Emirates Islamic Online Banking. If you haven’t yet registered for Online Banking, click here to register.

- Go to the Accounts section and select Open Account.

- Choose product type as Super Savings Skywards.

- Select the account currency (AED).

- Agree to the Terms & Conditions and click next

- Enter your Skywards Membership Number and click Next , and your new Super Savings Skywards Account number will be generated instantly.

Please note: If you don’t already have Skywards Membership Number, visit www.emirates.com to create it before proceeding.